Owning a home entails a considerable amount of obligations and costs, including home renovation tasks. Remodeling a kitchen, adding a bathroom, or putting in new windows are all expensive jobs.

If you’re a homeowner, you might be asking if the expenses for these upgrades can be written off on your tax return. The answer to the question “Are home improvement costs tax deductible?” and the information you need to know about making these deductions are covered in this article.

It’s crucial to remember that home remodeling expenses are often not tax deductible. You might be able to claim a deduction in some circumstances, though. Here are some circumstances in which you might be eligible to write off the expense of home improvements:

Home Office

You might be able to write off a portion of your home remodeling expenses if you utilize a certain area of your house only for work-related activities, such as an office. For instance, you might be able to write off some of the expense of remodeling your home office to make it more useful or to add more room.

Medical Necessity

You may be eligible to write off the cost of home renovations that are required for medical reasons, such as building a wheelchair ramp or a lift.

Read Also:

- Home Improvement Projects That Bring in the Most Returns at Resale

- Home Improvement Guide: Adding a Timeless Touch to Your House

- 7 Tips on Refinancing to Fund a Home Improvement Project

- A Guide to Finding the Lowest Cost Homeowners Insurance

Energy Efficiency

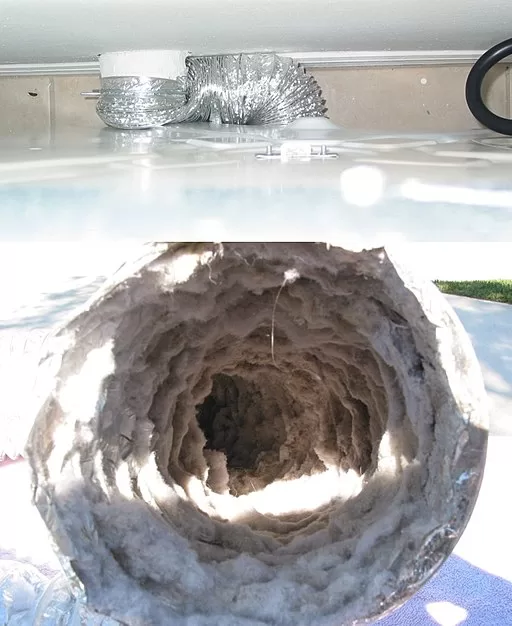

You may be qualified for a tax credit if you undertake home upgrades that are intended to increase your home’s energy efficiency, such as installing solar panels or improving your HVAC system.

Because it immediately lowers your tax liability as opposed to lowering your taxable income, a tax credit differs from a tax deduction.

Understanding the Limitations of Tax Deductions for Home Improvements

It’s crucial to remember that even if you qualify for a deduction or tax credit, the amount you can deduct is subject to a cap. For instance, the medical expense deduction is only accessible if your medical costs are above a specific amount.

The amount of the energy efficiency tax credit you can claim is capped, and only specific types of renovations are eligible for it.

The distinction between repairs and enhancements should also be taken into account. Repairs, such as replacing a broken window or patching a leaky roof, are normally not tax deductible because they are seen as a necessary aspect of property maintenance.

On the other hand, improvements are upgrades that raise your home’s worth or lengthen its useful life. The addition of a new room, kitchen remodeling, or the installation of a new heating system are a few examples of improvements.

If improvements meet the requirements listed above, they can qualify for tax credits or deductions.

Maintaining accurate records of your home remodeling costs is also crucial. The cost of the improvement, the date it was finished, and any receipts or invoices must all be documented. If you choose to claim a deduction or tax credit on your tax return, you will need this evidence.

In conclusion, the response to the question “Are home improvement costs tax deductible?” is not a simple yes or no. Even while expenses for home improvements are generally not tax deductible, there are some circumstances in which you might be eligible to claim a deduction or tax credit.

Home offices, medical emergencies, and energy efficiency improvements are a few examples of these circumstances. There are restrictions on how much you can deduct, so it’s critical to maintain accurate records of your costs.

As always, it’s a good idea to speak with a tax expert to make sure you’re getting the most out of your tax breaks and utilizing any credits or deductions that may be accessible to you.

You might be able to cut costs on your home renovation work while also lowering your tax bill with careful planning and documentation.